Artificial intelligence has emerged as the top choice for accounting technology investments in 2023. Accounting firms are making substantial bets on AI to stay in sync with industry trends, enhance their services, and boost efficiency, both for themselves and their clients.

According to the recent Intuit QuickBooks report titled “A Tech-Forward Future: Accounting in Canada 2023,” over half (52 percent) of accounting businesses in the country are planning to invest in AI, while around 46 percent have investments slated for automation tools and cloud accounting software.

Furthermore, a significant 89 percent of accounting professionals believe that AI can positively impact their industry. The report highlights that accounting professionals are eagerly anticipating the integration of automation and AI to improve efficiency, with most citing increased workflow efficiency as the primary benefit of AI.

Major accounting and consulting firms in Canada have reported heightened interest and activity in AI investments among their clients and within the accounting services sector. Jas Jaaj, Managing Partner of AI at Deloitte Canada, noted that AI is one of the fastest-growing sectors, even amid a generally recessionary environment. Accounting firms are focusing on applying AI to three key areas: enhancing internal operations, infusing AI into products and services to generate added value for clients, and equipping employees with AI-enabled tools.

In addition to AI, cloud transformation and data management are major trends reshaping how organizations consume and produce information. Cloud transformation is seen as a means to enhance innovation by facilitating easier access to features like AI and integrating them into applications.

AI technologies, particularly supervised machine learning, have been employed in the accounting industry for approximately a decade to streamline labor-intensive processes. However, the recent emergence of generative AI, exemplified by ChatGPT, has prompted accounting firms to explore new ways to leverage these available tools.

PwC Canada, for instance, has committed to investing $200 million to expand its AI capabilities and train its workforce in the use of generative AI. They are actively identifying use cases for AI techniques and tools in collaboration with clients through pilot projects.

AI is expected to transform traditional accounting roles, which often involve tedious manual work, into more advisory roles, where professionals can apply their knowledge more effectively.

Simon Lindley, a data analytics trainer and consultant, emphasizes the importance of accounting firms embracing AI now to save time in the future, even if some efforts initially result in immature tools. Lindley believes that there will be a demand for professionals who understand both AI technology and accounting, emphasizing that waiting until AI matures and becomes widespread is not a viable strategy.

While AI is expected to replace some roles in accounting, there will be a need for individuals who possess expertise in both AI and accounting and can responsibly apply AI in the industry.

However, there are concerns about the responsible use of AI and data privacy. Jas Jaaj mentions that as companies integrate AI into their processes, there is growing pressure on governments to manage information and ensure data trustworthiness. Bill C-27, which aims to enact Canada’s Consumer Privacy Protection Act, the Personal Information and Data Protection Tribunal Act, and the Artificial Intelligence and Data Act, is currently under review and is expected to address these issues.

In conclusion, accounting firms are recognizing the transformative potential of AI and are actively investing in it to enhance their operations and services. They acknowledge the importance of responsible AI adoption and data protection as they navigate this technological shift.

Government of Canada launches consultation on the implications of generative artificial intelligence for copyright

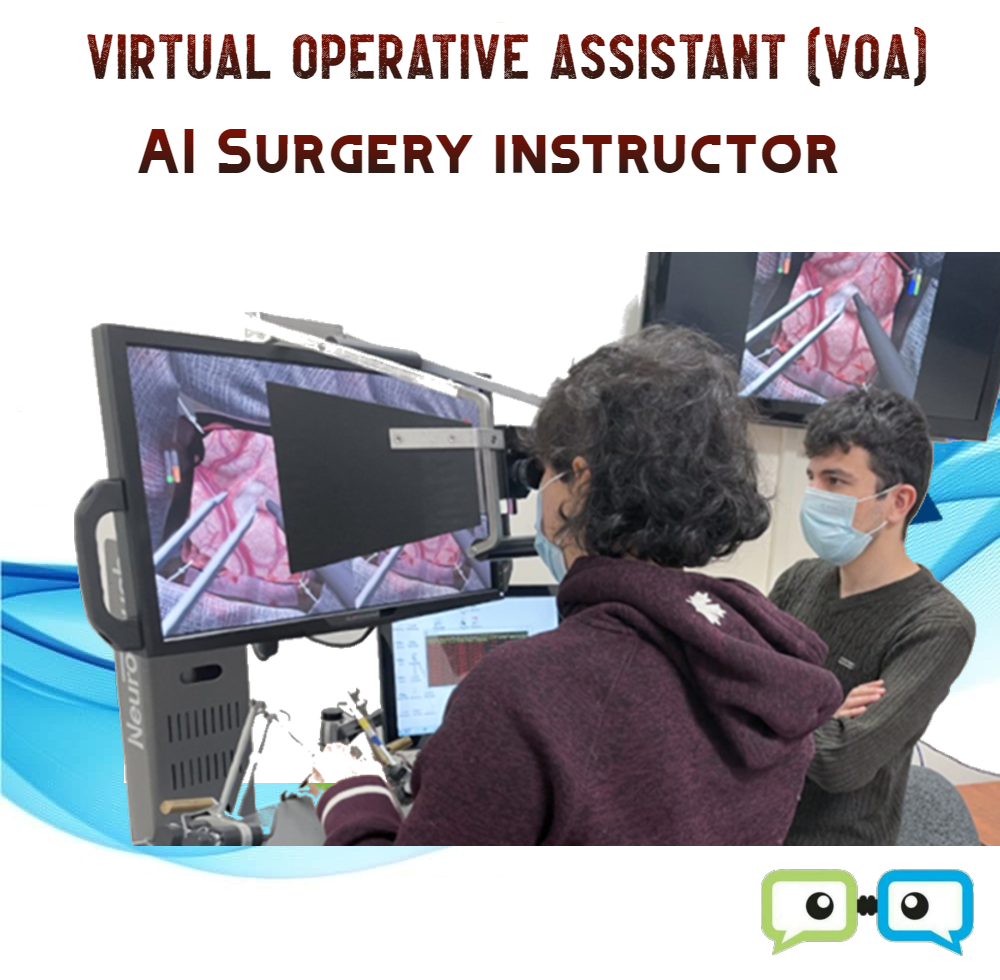

Government of Canada launches consultation on the implications of generative artificial intelligence for copyright  Artificial intelligence instructors in neurosurgical training

Artificial intelligence instructors in neurosurgical training  IBM has chosen Quebec to quantum system in Canada

IBM has chosen Quebec to quantum system in Canada  5 Top Montreal SAAS Startups to Watch in 2022

5 Top Montreal SAAS Startups to Watch in 2022  Vancouver has produced 7 unicorn companies in 2021

Vancouver has produced 7 unicorn companies in 2021  IVADO Labs $51M Artificial Intelligence investments

IVADO Labs $51M Artificial Intelligence investments